4in10 Newsletter 12.05.22

Read the latest 4in10 Newsletter here.

To get this directly to your inbox every fortnight please do join us.

Read the 4in10 Newsletter 31.03.2022

Action needed, news, information, funding, jobs and more. Get it delivered direct to your inbox fortnightly. Sign up here.

London Elections 2022. Influence your candidates NOW!

London Elections 2022.

Influence your candidates to take action on child poverty.

On 5 May 2022 in all 32 London boroughs apart from The City of London, every council seat is up for election.

This presents a once-in-four-year opportunity to grab the attention of those who would represent us, tell them about the impact of poverty on the city’s children and what they must do to tackle it. With child poverty rates in London among the highest in the country and many families are now facing severe hardship in the face of the cost-of-living crisis, it is a matter of urgency that those seeking election to their local council prioritise tackling child poverty in their communities.

4in10, alongside other organisations in the London Child Poverty Alliance, is asking its members to engage with candidates in these elections to encourage them to sign our pledge to work towards a child poverty free London.

We hope that as a result, on 5 May there will be hundreds of local government elected officials who are better informed about how they can tackle child poverty in the local communities and are ready to take action to do so.

Manifesto for a child poverty free London

The London Child Poverty Alliance’s Manifesto for a Child Poverty Free London sets out twelve key ‘asks’ that it believes if put into action, would make a significant contribution towards creating a child poverty free London. The asks are focused on four key areas:

- Action on income

- Action on housing

- Action on childcare

- Action on hunger

The manifesto website provides prospective councillors with good practice examples, local data and further information about how these can be put into practice in their communities. It also contains a signup page where they can publicly commit to work towards a child poverty free London.

Take part in the campaign

First and foremost, we are asking you to share the manifesto with your staff, volunteers and those you work with and ask them to ask candidates they meet to sign up to the pledge via the manifesto website.

If you have the capacity, you could also send manifesto to the candidates in your ward, or across the area where you are based, asking them to sign the pledge.

The easiest way to find out who your local candidates are is to visit the Who Can I Vote For? website and enter your postcode. Alternatively, you could contact the local offices of the main political parties to ask them for their contact details.

Also look out for local hustings events going on in your community and if possible attend one. These will provide an opportunity for you to ask the candidates what they plan to do to tackle child poverty, you can use the manifesto to help you decide what to ask.

If you need any support or have any questions, please contact us and we’ll be very happy to assist.

Register to vote

And finally, don’t forget to register to vote! It is possible to register to vote even without a permanent address. The deadline to apply is 14th April and the deadline for applying for a postal vote is 19th April. Contact your council’s electoral services team for more information.

Useful resources

London Councils Guide to How elections work

Guidance from the Charity Commission on campaigning during election periods

Interesting Blog from New Philanthropy Capital

What Will Spring Statement the Spring Statement Mean for Charities.

Thank you to NPC for allowing us to share this. For more information click here:

Spring is upon us. Flowers are blooming, birds are finally singing—and the sound of tweeting will reach deafening levels this week as the change of seasons also brings a new Spring Statement from the Chancellor. But as new beginnings go, the outlook has looked brighter.

A lot has happened since the somewhat optimistic-feeling autumn budget, and not much of it has been good for the charity sector: a war in Europe, the subsequent economic and social fallout, and spiralling living costs across the country. With this backdrop, ‘levelling up’ has dropped down the agenda, but it cannot be forgotten. More than ever, we need to see the budget deliver for marginalised groups who are most vulnerable to these social and economic shocks.

What will be the big themes of the budget?

In the short term, the overall economic outlook is pretty bleak. Inflation is rising to 30-year highs and may hit double digits, with another spike likely in the autumn. Disposable income is set to see the largest annual fall in 50 years. The government already announced a rise in the National Insurance rate—and although they may be scrapping this for the lowest paid workers, it will provide little salvation to those most affected by rising costs. The Chancellor has teased that rising food and fuel prices are likely to be confronted with a package of support, in addition to the £350 package announced in February—which now seems like a drop in the ocean. However, rumoured defence spending rises and support for Ukraine may limit the Treasury’s ability to ease people’s concerns.

We also have huge labour market vacancies, with around 1.2 million fewer people in the labour market compared to pre-pandemic trends. This is driven both by the young, but also by over 50s who have left the labour market completely. The Treasury will likely be thinking closely about this and an update to the plan for jobs is expected on Wednesday.

What should charities be expecting?

There may be tough times ahead for the charity sector. The combination of rising costs, rising demand and inflation, leading to a decline in value of grants and donations, could be a serious one for charities. What is certain is that as an abstract ‘cost of living crisis’ moves into a desperate ‘can’t heat my home’ crisis, charities will be ever more in need.

Along with the support for household bills already mentioned, there have been some rumoured benefit changes which the Chancellor may employ to try and soften the blow. For example, lowering the taper rate of Universal Credit again, or raising child benefit or pensions, but in the short term this is unlikely to seriously alter the circumstances of many people that charities support.

Charities whose work concerns Ukraine should also expect specific announcements around the crisis—both in terms of more support for resettling people in communities here, and also in terms of increased aid for organisations working closer to Kyiv.

What about levelling up?

With everything else that’s in the news, the mission to ‘level up’ the country has fallen down the agenda. However, the pain people will be feeling over the coming months means that this support is needed more than ever.

The largest levelling up fund yet to be allocated is the UK Shared Prosperity Fund (UKSPF). This is meant to replace EU funding for business support, community infrastructure, and employment and social exclusion support. The prospectus for the UKSPF is due soon, and allocations to lead authorities may be made as early as the Spring Statement. Given the labour market vacancies, this would be welcome.

What may be missing, however, is support for tackling social needs. In the pre-launch guidance for the UKSPF, the government quietly revealed that new funding for people and skills may not be available until 2024 / 25. As we outlined in our recent briefing, this could leave a three-year gap in new funding which will affect the most marginalised in the country the most, and will risk progress on the levelling up agenda.

At NPC, we’re worried this is going to blunt charities’ ability to deliver for communities around the country at a time when they are needed most. Following on from our briefing, we will be running an event on the UK Shared Prosperity Fund next month, focused on how charities and local government need to work together to ensure people don’t lose out on support. This will be vital viewing for anyone trying to tackle social exclusion or improve employment in communities around the country. Further details announced soon.

Longer-term, we are focused on ensuring that the lessons from projects working on social issues around the country are kept at the heart of future levelling up plans. Later this year, the government will be launching its Strategy for Community Spaces and Relationships. We know how much there is to learn from work that’s already happened, and we will be pulling together best practice from community initiatives across the country, along with fresh thinking, to design plans that can genuinely tackle the social needs that people see as key to the success of levelling up.

The Spring Statement is unlikely to bring a new start for the charity sector, but we know many charities have already planted seeds which address the issues communities care about. We want to help them grow and thrive elsewhere.

Get in touch with Theo.Clay@thinkNPC.org if you want to learn more.

Read 4in10's Latest Newsletter Here

News, Campaigns, Data, Funding and More.

To receive our newsletter every fortnight directly to your inbox, join us here.

Spotlight on 4in10 Member Praxis and the NRPF Action Group

How are you helping to tackle child poverty in London?

Praxis is a charity for migrants and refugees. We provide immigration advice, housing and peer support and through all of these ways our work helps to protect children from poverty. We have become a leading expert in finding pathways out of destitution and supporting migrants facing homelessness, and our training and campaign work has national and international impact. Our core purpose is to help migrants in crisis or at risk, ensuring they can live in safety, overcome the barriers they face, and take control of their own destinies. You can read more about our strategy here, find us on Facebook, Twitter and our website here.

As part of this work, we facilitate the No Recourse to Public Funds Action Group, which is made up of campaigners with lived experience of the No Recourse to Public Funds (NRPF) policy, to build campaigns to end this policy. You can find out more about our campaign, and read the NRPF Action Group’s manifesto calling for the end of NRPF here.

Tell us something you are excited about?

We are really excited that the group has decided to focus on campaigning for free school meals. The overarching goal of our campaign is to ensure free school meals for all children living in poverty, regardless of their parents’ immigration status. We’re launching with a specific call to the Government to make permanent the temporary extension of free school meals to some groups of children living in poverty affected by No Recourse to Public Funds, which was brought in during the pandemic.

We are also calling for free school meals for all children in poverty, regardless of immigration status, to take into account the fact that children with insecure immigration status are not covered by the extension of eligibility.

Our policy briefing sets out our campaign asks in more detail – you can find that here;

Additionally, here are some posts you can share if possible:

- Facebook: https://www.facebook.com/PraxisCommunityProjects/posts/325409016299148

- Twitter: https://twitter.com/Praxis_Projects/status/1500765019050500096

- Instagram: https://www.instagram.com/p/CazDWYtoCQa/

- LinkedIn: https://www.linkedin.com/feed/update/urn:li:activity:6906533946969186304

If you can support our campaign on social media, in your email networks and newsletters, this would be hugely appreciated! Please do reach out if you would like to collaborate in any way!. Any support you can offer to our campaign is hugely welcomed and thank you for all you do – Pascale.robinson@praxis.org.uk

Share with our members something positive about your organisation’s achievement or service?

We were one of the organisations that helped to uncover the Windrush Scandal originally and we’re proud to have been part of the work to campaign to change the system.

What can other network members learn from you or find out more about through you?

- We can offer advice for those who need help navigating the migration system: Get Help — Praxis for Migrants and Refugees.

- We are experts in finding pathways out of destitution and supporting migrants facing homelessness. Please reach out to collaborate on this!

- We can offer training on the immigration system for a variety of organisations (depending on our capacity).

What would most help you achieve your goals?

We want to make sure that migrants can live in safety, overcome the barriers they face, and take control of their own destinies. To do this, we campaign for systemic change. We’re building alliances and working in partnership with experts by experience to create positive, long-term changes to the policies and practices that create exclusion and destitution. We’d love to collaborate on work to achieve these goals!

Why did you join 4in10? What do you enjoy about being part of the 4in10 network?

Though we have only been in contact with the 4in10 team for a short while, 4in10 has already provided a brilliant chance to forge connections and collaborate with other amazing organisations working in the capital!

We are so looking forward to working together more, especially on our campaign to make sure all who need them have access to free school meals regardless of their immigration status.

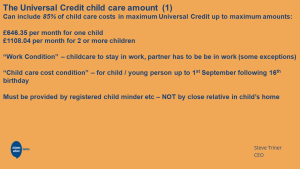

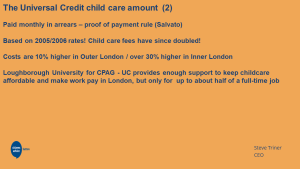

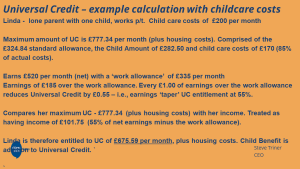

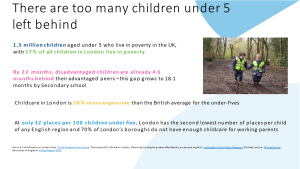

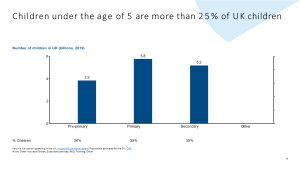

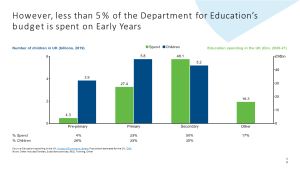

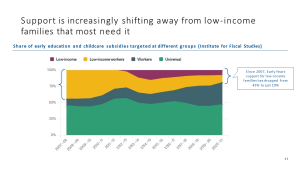

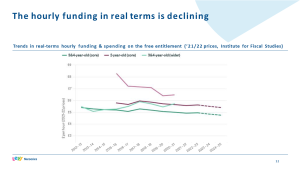

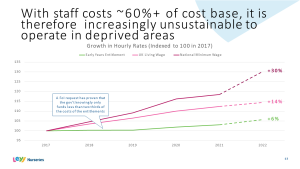

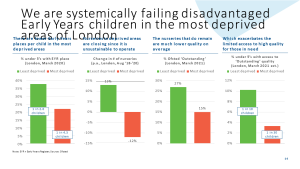

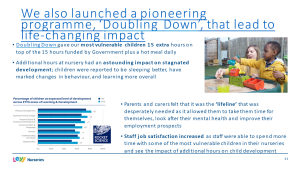

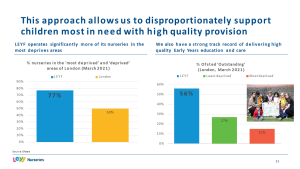

Fantastic 4in10 Coffee Morning on Child Care

4in10 Coffee Mornings are always full of great people and good things. Just to wet your appetite for future ones and to give you some insight into why we chose child care as the issue for today you can find the slides below.

Thanks to Steve Triner from Sutton CAB and Samantha Creme from the London Early Years Foundation.

4in10 Newsletter

The latest news, data, jobs, funding and more from 4in10, members and friends.

To get the latest issue directly to your inbox every other Thursday sign up here.

Proposals for a new Bill of Rights: what would it mean for children living in poverty in London?

Katherine Hill, 4in10’s Strategic Manager, takes us through the issues:

The story of Human Rights Act (HRA) reform has been a long and somewhat torturous one. Governments of various guises have been consulting on what changes might be needed since the mid-2000s, only a few years after the Act came into force. While the content of these proposals has changed over time the one constant has been that those who have made the effort to respond diligently to each round of consultation have almost unanimously concluded that there is no solid case for reform; the Act is doing the job it was intended to do, effectively defending ordinary citizens against the exercise of excess power or neglect by the state.

Most recently the Independent Human Rights Act Review (IHRAR) set up by the Government to take (yet) another look at the Human Rights Act reported that, “[t]he vast majority of submissions received by IHRAR spoke strongly in support of the HRA.” And the separate but concurrently running inquiry carried out by the cross-party Joint Committee on Human Rights concluded: “[t]o amend the Human Rights Act would be a huge risk to our constitutional settlement and to the enforcement of our rights”. Why, then, has the Government now published proposals for wide-ranging and significant changes to the way the Act works? We all know that evidence-based policy is out of fashion, but this seems to have gone one step further. It is embracing policy in that is in direct contradiction with the evidence. This is policy driven by ideology pure and simple.

At this, the temptation may be to throw up our hands and leave the beleaguered Human Rights Act to the hands of fate. What is the point of repeatedly making the case for it, only to be ignored? There are two reasons. Firstly, we must recognise that the case for effective human rights is one that needs to be constantly remade, it will never be a case of job done. Human rights, if they are to mean anything, must be a statement of collective values, an expression of our shared commitment to freedom, respect, equality, dignity and autonomy for all humans. For these to be transmitted from generation to generation there needs to be ongoing dialogue about them and what they mean in our modern world. Shying away from that conversation leaves the legal mechanisms we have for defending our rights vulnerable to attack.

Secondly, and more pragmatically, if we do not argue and win the case for the Human Rights Act, and these current proposals for reform come into force, ordinary citizens may lose the means to enforce their rights effectively. For those 4in10 exists to advocate with and for, families and children experiencing living in poverty in London, the consequences are potentially very serious indeed.

The proposed reforms aim in multiple ways to make it harder for people to enforce their rights. These include a proposal to introduce of a new step in the legal process requiring individuals to demonstrate that they had experienced “a significant disadvantage” before their case can go to court. Legal action can already only be taken if the individual is the “victim” of a human rights breach, so it is hard to view this as anything other than an attempt to deter people from enforcing their rights by adding a further legal hurdle to the process. This will disproportionately affect those experiencing poverty who are more likely to have their rights breached in the first place. To give just one example, children in the lowest income quintile are 4.5 times more likely to experience severe mental health problems than those in the highest.[1] It follows that some of those are more likely to experience mental health detention too, where their human rights – including the right to respect for private and family life (article 8) and right to liberty and security (article 5) – will be engaged. If children in these circumstances, who already find it very difficult to access justice, have to jump through additional hoops it will further diminish their ability to challenge their detention where they believe it is an unlawful breach of their human rights.

The Government’s proposals would introduce a two-tier system for enforcing human rights by restricting their use in the domestic courts by certain groups, including “foreign criminals” and those accused of illegal migration. This makes a mockery of the values underlying the whole notion of human rights. These are rights that everyone is entitled to enjoy regardless of economic or immigration status, gender, sexuality, disability or anything else. It follows that all should have equal access to the law to enforce them. If they don’t, the impact will be felt most by those on the margins, and especially the poorest children in our society. If the Government is more easily able to deport people without them being able to challenge this on the grounds of right to respect for private and family life (article 8), families may face the sudden loss of their main breadwinner, and children living in already financially precarious situations will be plunged into deeper poverty.

A key issue the Government seeks to address through its plans is that it wants to stop what is termed ‘judicial overreach’, that is the courts getting involved in decisions that are more properly the role of Government and Parliament, accountable as they are to the people. High on the list of things the Government believes it is best placed to make decisions about is the allocation of social and economic resources and it is particularly aggrieved when it thinks the courts seek to interfere in these issues.

The reality is however, that there is little evidence that this is what the courts in the UK are routinely doing. Recent cases that have examined welfare policy have often been unsuccessful, for example a challenge to the two-child limit (which does not allow welfare payments to be made to third and subsequent children) on the grounds that it discriminates against lone parents. The courts found these to be matters on which Parliament has deliberated and struck an appropriate balance. This may be very disappointing for those of us who believe that there should be a wider role for human rights in these matters, and that the right to an adequate income, a safe and warm home and access to healthy food meet basic human needs that should be enforceable whatever the colour of government in town. But it certainly does not support the Government’s argument for the need to curtail the powers of the courts, and the rights of individuals, as is proposed.

Over the longer-term we need to build the case and argue robustly for more comprehensive protection of these important economic, social and cultural in our domestic legal framework, as an essential element of any strategy to eradicate poverty. But first, and most urgently, we need to protect what we already have in the form of the Human Rights Act, as failing to do so will have the greatest impact on those who most need to rely on it.

To find out more about the Government’s plans to reform the Human Rights Act and to find out how you can respond to the consultation visit the British Institute of Human Rights dedicated web pages where you can find lots of easily digestible information and advice.

[1] Gutman, L., Joshi, H., Parsonage, M., & Schoon, I. (2015). Children of the new century: Mental health findings from the Millennium Cohort Study. London: Centre for Mental Health.

4in10 Newsletter 6th Jan 2022

Read our fortnightly newsletter here with news, calls to action, funding, jobs, free training and more. To receive this in your inbox every other Thursday just complete our . Everything is completely free!